A Lithium Boom for Nevada?

About Lithium

Lithium is the lightest solid element in the periodic table. Only hydrogen and helium have smaller atoms, and a lump of lithium will actually float in oil! It is a silver-white metal in the Alkali Metals group, which also includes such well-known elements as sodium and potassium. The group is distinguished by their extreme chemical reactivity. None of these metals exists in pure form in nature, as they react quickly with both air and water. In air, they immediately form an oxide tarnish and if heated can burst into flame. In water, they react violently to release burning hydrogen and sparks.

| | |

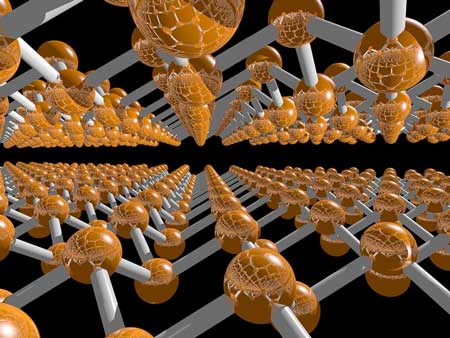

This reactivity is due to freely available outer electrons and makes the entire family very amenable to battery construction, especially where rechargeability is a priority. Research over the past decades has shown lithium to be especially well-suited due to its having:

- the highest reduction potential of the group - it yields electrons most easily to produce electric current

- high energy capacity per unit weight, being both efficient and very light

- rapid charge/discharge cycle times for the best lithium battery designs

- fewer long-term chemical side effects, which can reduce overall battery life

This important element also has other uses, such as in metallurgy, lubricants, and antidepressant drugs. However, it is the exponential demand growth for rechargeable batteries that is currently driving a rapid market expansion, raising prices, and spurring exploration for new sources.

Lithium Mining

Lithium is not particularly rare in the earth’s crust but, like most metals, it can only be economically mined in locations where geologic processes have produced local deposits of much higher-than-average concentration. These may be traditional hard-rock deposits requiring mass excavation or, owing to the high water solubility of lithium compounds, they may be natural brine reservoirs or their remnants in dry lake beds. Both types of deposits can involve high development costs and environmental impacts.

Currently, the United States is a relatively minor contributor to worldwide production. We have only one operating lithium mine, at Silver Peak, NV, owned by North Carolina-based Albemarle Corporation. The facility, which has been producing since the 1966, extracts lithium salts from a large underground brine deposit, with the end product being lithium carbonate power.

| | |

The two most promising deposits for future lithium mines in the United States are also located in Nevada. Thacker Pass in in Humboldt County, near the Oregon border. It is a project of Vancouver, BC-based Lithium Americas Corporation. Rhyolite Ridge is in Esmeralda County, only twelve miles from the Silver Peak mine. It is a joint project of an Australian company, Ioneer Ltd., and South Africa-based Sibanye Stillwater Ltd.

Both prospects are hard-rock deposits and, as such, will require major excavation to extract the ores. They are undergoing very stringent impact reviews. Concerns for Thacker Pass include nearby sacred sites of Indigenous tribes, water consumption, and local wildlife impacts. With Rhyolite Ridge the primary issue is a rare plant species, Tiehm’s buckwheat, only known to grow at that location. Both projects have seen recent favorable court decisions, but it is always difficult to predict when major mining projects will see production. Rhyolite Ridge currently predicts 2025 and Tacker Pass 2026, but these dates may be optimistic.

Will The Silver State Become the Lithium State?

Nevada’s nickname is actually outdated. Gold now dominates our total mineral production by value, with copper a distant second. What role could lithium play in our economy over the coming decades? It is still too early to predict. The two new projects described above illustrate the dilemmas that the new renewable energy economy can present. While there are clear benefits to expanding the use of clean electric power, and efficient battery storage will be critical to that effort, increased lithium production presents significant environmental and development costs of its own. Even an optimistic view must still account for how the market would respond to supply and pricing challenges, as alternatives exist. That is positive for the future of alternative energy nationwide, but Nevada’s role could be impacted.

There are a number of research projects looking at the feasibility of high-performance batteries using Sodium or Potassium. Both are abundant and have low extraction costs and environmental impacts. Their use in commercially viable batteries for applications like electric vehicles or home solar power backup is likely years away, but any projection looking out decades must take this into consideration.

Battery backup will also be a requirement for electric utilities as they gradually phase out fossil fuel generation. Wind and solar are intermittent energy sources and require power storage to cover the mismatch between peak loads and optimal generation periods. Home solar installations with integrated backup can offload some of this demand but that is unlikely to keep up with the rate of fossil fuel plant retirement. In fact, net metering agreements often make in-home battery installations less attractive financially than reliance on the utility for backup.

However, the requirements for grid-level battery storage are quite different from vehicles and homes. Size and weight are generally not a constraint. Charging and discharging can occur at a more predictable, measured pace. The primary criteria are:

- high storage capacity and ability to deliver consistent output for hours

- reasonable initial cost

- thousands of charge/discharge cycles without major loss of capacity

- reliability and low maintenance

This means that other promising technologies based on low-cost materials, notably the Iron Flow battery, are more likely than lithium to fill this demand over the long run.

Also limiting the potential of lithium for grid level backup is the fact that fossil fuel plants may be replaced in part by other Base Load (continuously operating) sources. Major advances in nuclear fission technology, particularly with regard to safety, have revived its prospects as a carbon-free power source. Even some environmental activists who were previously hostile to nuclear energy are giving it a second look. In Nevada, about nine percent of our total electric demand is met by geothermal generation, which is also a Base Load technology. For California that portion is nearly six percent, which is over five times our capacity, and many other western states have significant geothermal resources that have only begun to develop. Hydroelectric power already plays a major role in some regions, and about six percent of total U.S generation, but its further development is not a favored renewable energy strategy. Some coastal states are considering tidal power generation, which is still a relatively new technology but may see significant growth. Nuclear fusion holds great promise as perhaps the ultimate clean energy source. It has none of the safety and hazardous waste risks of traditional nuclear power. However, due to daunting technological challenges it remains in the research stage after many decades of investment. It will probably not be a factor before the second half of this century.

The above discussion is intended to illustrate how difficult it is to predict the future direction of carbon-free energy. No one we can really project the long-term role that lithium will play in Nevada’s economy. We can say that there will be major changes from this point forward and it will be interesting to experience. Hopefully, the disruptions will be minimal.